|

College Park, Md. (UPI) May 18, 2011 Economists expect the National Association of Realtors to report Thursday that existing home sales were 5.2 million in April, up modestly from 5.1 million in March but down significantly from 5.8 million April 2010. If April sales come in lower than economists expect, stock and bond investors will interpret this as bad news. Along with declining housing starts, slow traffic at new home showrooms and flat industrial production data for April, disappointing existing home sales would be interpreted by investors that the already weak economic recovery is losing steam. My view is that both equity and bond traders are misreading housing and industrial production data. The U.S. housing market was already holding back the recovery -- nothing new in these data indicate a much larger drag for the second quarter. The economy need not be led out of recession by new home construction and, for seven quarters, the economy has expanded without a housing construction recovery. Simply, during the boom of the last decade, millions too many houses were built -- many were sold to buyers who couldn't afford them and others as second homes. In the wake of the financial collapse, millions of homes are moving through bankruptcy sales -- albeit at a slower pace in recent months owing to the Robo Scandal. Still this overhang will keep new home construction subdued and kill the modest recovery in prices that began and then faltered last spring. Prices are likely to firm this spring and summer. Already prices have firmed in places like Washington, Manhattan and Dallas, thanks to strong employment and payroll growth in the federal government, finance and energy but, overall, buyers are more confident that a bottom has been reached. Don't expect rising prices to much add to consumer wealth and spending but we are nearing the end of the subtraction. Incidentally, you won't see this soon in the much-watched Case-Shiller, Standard and Poor's indexes of home prices, because those data lag several months -- March data will only be released May 31. Economic growth was a tepid 1.8 percent the first quarter -- demand was weighed down by the continuing slip in housing prices, higher gas prices, a drop in defense spending and bad weather slowing non-residential construction. The April data we are now seeing for industrial production reflects higher gas prices and the supply chain effects of the disaster in Japan. The nadir in defense spending and construction are reversing and manufacturers are finding ways to accommodate shortages from Japan. Moreover, oil prices have pulled back and gas prices are starting to level off and fall a bit. Economists are expecting second quarter growth better than 3 percent -- my forecast is 3.1 percent. In the second half, growth will slow but stay at more than 2.5 percent and the recent dip in corporate earnings and expectations will prove temporary. The key thing is that the data the stock market are panicking now about reflects a passed reality -- rising gas prices and falling home prices and construction and defense spending from the first several months of this year. By all reports those factors have either abated or reversed and, for now, the recovery -- though not a champ -- is stabilizing. Investors should continue to look for value -- they will be feeling much better about equities soon. After the usual spring lethargy passes, the summer rally will redeem the optimists. (Peter Morici is a professor at the Smith School of Business, University of Maryland School, and former chief economist at the U.S. International Trade Commission.) (United Press International's "Outside View" commentaries are written by outside contributors who specialize in a variety of important issues. The views expressed do not necessarily reflect those of United Press International. In the interests of creating an open forum, original submissions are invited.)

Share This Article With Planet Earth

Related Links Powering The World in the 21st Century at Energy-Daily.com

Obama to focus on energy, shale gas in Poland

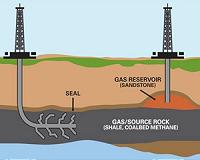

Obama to focus on energy, shale gas in PolandWarsaw (AFP) May 18, 2011 US President Barack Obama will focus on energy cooperation, including shale gas development, when he visits NATO partner Poland for the first time next week, a US diplomat said Wednesday in Warsaw. "Energy is a pillar of Polish-American relations and it is sure to be the subject of discussions when President Obama visits Warsaw next week," US ambassador Lee Feinstein told delegates to a shal ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2010 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |