|

by Lauren Krugel Calgary, Canada (SPX) Jun 17, 2010 Canada has the expertise petroleum-rich Kuwait needs to develop heavy oil resources in the Mideast country, which has been looking for ways to keep up long-term production, said a top engineer with Kuwait Oil Co. "We thought the good practice is to be close to the champion, or the leaders in this area," Bader Al-Matar, senior reservoir engineer with the state-owned oil firm, said in an interview this week. KOC had one of the largest and most lavish exhibits at the Global Petroleum Show in Calgary this week. But unlike most other exhibitors at the huge trade show, KOC had no particular products or services to boast - it simply wanted to cultivate relationships in Canada's oilpatch. Canada has the world's second-largest crude reserves behind Saudi Arabia, mostly in northern Alberta's oilsands. While the resource is vast, it takes considerable work to separate the oil from the sand and clay and process it into a type of crude refineries can handle. Al-Matar said Canadian expertise could be of use to Kuwait, which is reportedly in talks with heavyweights like Royal Dutch Shell, Total SA and ExxonMobil to help develop its heavy oil reserves. All three of those firms are players in the oilsands. France-based Total has operations in Venezuela, another major heavy oil producer. Kuwait holds about nine per cent of the world's oil reserves, much of which is higher-quality light and medium crude. "We are actually reaching the maturity stage, where our production will start to decline," Al-Matar said in an interview. "And we have to maintain that by exploring new resources, which is maybe heavy oil, and enhance our recovery with new technologies and techniques." The country has set oil production targets of four million barrels per day by 2020. The energy sector accounts for nearly half of Kuwait's gross domestic product and 95 per cent of all export revenues and government income, according to the CIA World Factbook. What the Kuwaiti needs to support future production growth is more hands-on experience in heavy oil, Al-Matar said. "In the real fields, we lack of that experience, frankly speaking, because we haven't yet implemented any heavy oil activities." In order for Kuwait to benefit from outside knowledge, it needs to open up its oilfields to foreign ownership, said Marin Katusa, chief investment strategist at Casey Research in Vancouver. It's hard for a company to justify lending its expertise, if it's not able to get a slice of cash flow in return. "Until they fundamentally change their legislation for the (purchase share agreements), that ain't gonna change," Katusa said. In contrast, China has recently announced a deal with Anglo-Dutch energy major Shell to jointly develop that country's enormous, but untapped, shale formations. "The Chinese are doing it the right way," said Katusa. As with heavy oil, it's costlier and more complicated to free natural gas from the non-porous shale rock. "They haven't really been able to really figure it out yet," said Katusa. "They need the North American technology." Over the past year, China has shown a keen interest in Canadian heavy oil. Its preference so far has been to join forces with Canadian firms that have the technical know-how. In return, the Canadian firms get a big injection of capital that may have otherwise been tough to secure. A month ago, a major Chinese sovereign wealth fund invested $1.25 billion for a stake in oilsands properties owned by Penn West Energy Trust (TSX:PWT.UN). Without the cash infusion, Penn West would not have been able to develop those properties any time soon. Penn West executives have said the knowledge exchange goes both ways. China's state-owned energy firms have some experience using steam to extract crude in some of their other ventures, which could be parlayed into Penn West's Peace River operations. The Penn West deal was announced a month after another Chinese state-owned company, refining giant Sinopec, bought a nine per cent interest in the world's largest oilsands project. Sinopec spent US$4.65 billion for a stake in the Syncrude Canada Ltd. partnership, which owns the gargantuan 350,000 barrel per day mining operation north of Fort McMurray, Alta. Sinopec previously acquired a 40 per cent interest in Total E and P Canada's Northern Lights project in 2008, bumping up its ownership to 50 per cent of the French-owned company's oilsands development a year ago. Another state-owned firm, PetroChina, announced in August it was making a C$1.9-billion investment in two projects operated by Athabasca Oil Sands Corp.

Share This Article With Planet Earth

Related Links What the Kuwaiti needs to support future production growth is more hands-on experience in heavy oil, Al-Matar said. Powering The World in the 21st Century at Energy-Daily.com

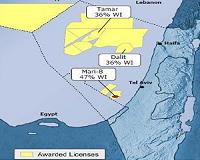

Israeli gas boom could ignite trouble

Israeli gas boom could ignite troubleTel Aviv, Israel (UPI) Jun 16, 2010 Israel's natural gas bonanza in the eastern Mediterranean just keep getting bigger, with reserves currently pegged at around 25 trillion cubic feet. That's enough to guarantee the Jewish state, dependent on imported energy since it was founded in 1948, energy security for at least two decades. The strikes at three fields, dubbed Tamar, Dalat and Leviathan, could even turn Israel ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2010 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |