|

New York (AFP) Sep 06, 2006 Crude oil prices fell to multi-month lows in New York and London Wednesday amid easing supply concerns and receding fears about a possible crisis involving Iran over its disputed nuclear program. New York's main contract, light sweet crude for delivery in October, tumbled 1.10 dollars to close at 67.50 dollars per barrel. At one point the benchmark contract fell as low as 67.40 dollars, the weakest since April 7 and some 14 percent below the all-time high of 78.40 dollars struck in July. Meanwhile in London on Wednesday, Brent North Sea crude for October delivery shed 1.16 dollars to settle at 66.93 dollars per barrel the lowest reading since mid-June. Crude futures were lower on "fading fears over potential supply disruptions," Sucden analyst Michael Davies said. "The market is lacking any little bullish news to support the prices." Fadel Gheit, analyst at Oppenheimer, said another factor was cooling economic conditions which translates into "a slowdown in demand ... especially in the Far East. Inventory levels are rising, putting more pressure on refined products." The analyst said oil markets have also avoided disruptions from hurricanes such as those from last year. "There is very small chance that we will have any serious hurricane disruption in the West," he said. "Traders are not as nervous as they were a year ago." A key focus for traders remained Iran, the world's fourth-biggest producer of crude, which defied the August 31 deadline set by the UN Security Council to suspend its uranium enrichment work or face UN sanctions. Further talks with European powers are now planned, while no sanctions have yet been imposed. Bart Melek, senior economist at BMO Nesbitt Burns, said the market appears convinced there will be no immediate crisis that will shut down exports from Iran. "With the probability of robust sanctions receding, traders are increasingly comfortable in removing the price premium associated with the possible disruption of oil flows from the Persian Gulf, pointing towards even lower oil prices in the near-term," Melek said. The United States and other major world powers suspect Iran is using its nuclear enrichment program as a cover to make nuclear weapons. Iran claims its nuclear ambitions are peaceful. Should Iran face economic sanctions, however, analysts warn that the Islamic republic could retaliate by disrupting its oil exports, in turn leading to rocketing oil prices. Elsewhere, prices were being weighed down by news of an oil and gas find in the Gulf of Mexico, described as a "significant discovery" by its finders, traders said. Three energy companies, US-based Chevron and Devon Energy, and Norway's Statoil, announced the find on Tuesday amid suggestions it could raise US reserves by as much as 50 percent.

Source: Agence France-Presse Community Email This Article Comment On This Article Related Links Powering The World in the 21st Century Powering The World in the 21st Century at Energy-Daily.com

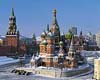

Moscow, Russia (RIAN) Sep 05, 2006

Moscow, Russia (RIAN) Sep 05, 2006Moscow's mayor warned Tuesday that the capital could face an energy deficit of 20% this winter, sparking concerns that temporary business closures seen in January could be repeated. "Energy consumption is abnormal at present and the deficit registered in the past is very large," Yury Luzhkov said. |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2006 - SpaceDaily.AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA PortalReports are copyright European Space Agency. All NASA sourced material is public domain. Additionalcopyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |