|

London (AFP) Feb 8, 2011 Brent crude oil fell under $98 on Tuesday as investor sentiment was hit by the outlook for demand in China after Beijing hiked interest rates again to cool its booming economy. The price then recovered, however, in late London deals to close in on $100 as the dollar weakened, making crude cheaper for holders of rival currencies. Brent North Sea crude for delivery in March fell to $97.51 -- its lowest level since late January -- before clawing back to $99.80, up 55 cents from Monday's closing level. New York's main futures contract, light sweet crude for March, tumbled as low as $85.88. The contract, which is also known as West Texas Intermediate (WTI), later stood at $86.65, up 17 cents. The price of Brent oil is higher than its WTI counterpart because of large supplies of crude that remain at the key US transit point of Cushing, Oklahoma, according to analysts. "Crude oil prices extended losses and fell sharply following China's surprising move to raise interest rates that added further pressure on the oil market amid concerns about the levels of Chinese oil demand," said Sucden analyst Myrto Sokou in London. China on Tuesday raised interest rates for the third time in four months as authorities ramp up efforts to tame inflation amid fears it could trigger social unrest. In October, the People's Bank of China hiked rates for the first time in nearly three years as it tried to mop up a flood of liquidity which has been fanning inflation and driving up property prices. It tightened policy again on Christmas Day. China is second only to the United States in oil consumption and a major importer so any prospect that demand will fall there is a major concern for the markets. Prior to the China news, oil prices were already falling on the back of easing worries over the Egyptian political crisis. "Though the situation in Egypt is far from resolved, a slight improvement in the overall tensions surrounding this region helped calm nerves somewhat," Barclays Capital said in a report. Brent crude spiked to $103.37 last Thursday -- the highest level since September 26, 2008 -- as traders fretted that the crisis could disrupt crucial crude supplies via the strategic Suez Canal. The canal through Egypt provides a sea link between Europe and Asia, allowing ships safer and faster travel between the two regions without having to sail around Africa. Egypt's embattled President Hosni Mubarak took a step towards democratic reform on Tuesday in another bid to appease opponents as mass street protests against his regime entered a third week. Mubarak has issued a decree forming a committee to oversee constitutional changes ahead of elections later this year, said Vice President Omar Suleiman, whom many now see as the effective power behind the throne. Although Egypt is not a major oil producer, 2.4 million barrels a day is transported through the Suez Canal. burs-rfj/bcp/bmm

Share This Article With Planet Earth

Related Links Powering The World in the 21st Century at Energy-Daily.com

Oil giant Shell's shale gas plans stir S.African controversy

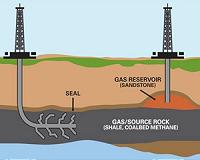

Oil giant Shell's shale gas plans stir S.African controversyCape Town (AFP) Feb 8, 2011 Energy giant Royal Dutch Shell is targeting potential untapped shale gas reserves in coal-hungry South Africa where landowners - including a Dutch princess - are readying for a showdown. Shell applied in December to explore 90,000 square kilometres - twice the size of Denmark - for gas deposits in the clay-like shale rock of the arid central Karoo. "The shale gas potential is quite hig ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2010 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |