|

Algiers, Algeria (UPI) Dec 17, 2010 Algeria's oil industry, battered by an investigation into high-profile corruption in the state-run Sonatrach oil company, is seeking long-delayed exploration deals and pressing ahead with the Medgaz pipeline linking the gas-rich North African country to Spain. Medgaz, with a planned annual capacity of 280 billion cubic feet of natural gas, is expected to be inaugurated soon. Sonatrach has a 36 percent stake in the operating company, with smaller shares held by Spain's Cepsa oil giant and utilities Iberdrola and Endesa, along with Gaz de France. The project has fallen several years behind schedule, in part because of uncertainty over how Europe's future energy sources will shape up. Gas consumption in the European Union fell an average of 7 percent in 2009 and, the Financial Times reports, is "expected to take years to return to pre-crisis levels." Most analysts agree that North Africa is likely to have a vital role in supplying Europe's energy needs. Algeria has oil reserves of 12.2 billion barrels, about 1 percent of the world total. Its natural gas holdings are even greater: 159.1 trillion cubic feet -- around 2.4 percent of global gas reserves. But with the price of gas uncertain, producers are hesitant to get involved in major new investments. A combination of lower demand and surplus supply in Europe has driven prices down. So, "all sides have accepted that Medgaz won't work at full capacity during its first year in operation, or even for longer," observed Africa Energy Intelligence, a specialized Web site in Paris. "No doubt Algeria and the companies that own the pipeline will have to wait for an upturn in the market -- predicted for 2014-2015 -- to materialize before Medgaz can come into its own," AEI said. The Algerians have also seen the construction of another gas pipeline, Galsi, which was due to run under the Mediterranean to Italy, postponed until prices go up again. Other Sonatrach gas projects have been shelved or postponed because of the corruption probe, which is widely seen as a power struggle between President Abdulaziz Bouteflika and Algeria's military-backed intelligence service. Algerian expectations regarding another major gas route, the 2,600-mile Trans Sahara Pipeline from Nigeria across Niger to Algeria's Mediterranean coast, have been diminished by the situation in Europe. Financing is a problem. The estimated costs for the TSP have increased from $7 billion to $13 billion over the last four years. On top of that, and the technical and political challenges involved in building the pipeline, there are serious concerns about security in all three states. All are grappling with insurgencies of one kind or another. Even so, Europe's needs are expected to rise by 3.53 trillion cubic feet a year to 4.24 trillion by 2020, an increase of about 30 percent. Much of this is expected to covered by Algeria and Egypt. Umberto Quadrino, chief executive of Edison of Milan, Europe's oldest energy company, estimated the two North African states could deliver an extra 25 billion-30 billion cubic meters a year between them. However, Sonatrach's problems in the gas sector have been deepened by bureaucratic inertia and a global economic downturn. Sonatrach President Mohamed Meziane, a key Bouteflika ally, and three of his four vice presidents were removed from office early in 2010. Meziane himself is languishing in prison on corruption charges. Energy Minister Chakib Khelil was also replaced. But it wasn't until May that a new top management team was installed to run Sonatrach, the largest energy monopoly in Africa and the sixth largest gas producer in the world in terms of reserves and production. This resulted in managerial paralysis at a time when key projects had already been delayed. It wasn't until September that the new leadership was able to crank up the program to develop Algeria's energy infrastructure. A new licensing round for 10 blocks across five onshore basins was announced. The Middle East Economic Digest, published in the United Arab Emirates, said that has raised expectations of "a new dawn" for Algeria's hydrocarbons industry. "If there's one thing Algeria cannot afford, it is the mismanagement of its hydrocarbons reserves," MEED observed. Since oil and gas accounts for 97.5 percent of Algeria's export earnings, "it is imperative that the third licensing round is a success," MEED stressed.

Share This Article With Planet Earth

Related Links

Who Uses The Most Electricity In Germany

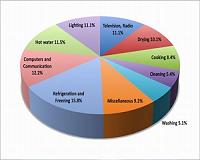

Who Uses The Most Electricity In GermanyBonn, Germany (SPX) Dec 14, 2010 Since 1990, the consumption of electricity in Germany has risen by about one third. Despite more efficient household appliances - for example, refrigerators, energy-saving light bulbs and computers, the VDE (Germany's trade association for the electrical, electronics and information technology sectors) envisages a further increase of almost 30 percent between now and 2025. There is a vast ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2010 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |